•Banks may sell over $5bn, says official, Cardoso faces Senate Tuesday over naira fall

Amid its fresh moves to stabilise the nation’s volatile exchange rate, the Central Bank of Nigeria has ordered Deposit Money Banks to sell their excess dollar stock latest February 1, 2024.

The CBN, which made the disclosure in a new circular released on Wednesday, also warned lenders against hoarding excess foreign currencies for profit.

According to officials, the central bank believes some commercial banks hold long-term foreign exchange positions to enable them profit from the volatile movements of exchange rates.

The new circular introduces a set of guidelines aimed at reducing the risks associated with these practices.

In the circular titled, “Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks”, the CBN raised concerns over the growing trend of banks holding large foreign currency positions.

The latest circular came barely 48 hours after the CBN released a circular, warning banks and FX dealers against reporting false exchange rates, among others.

The new development also came on the heels of the adjustment of the methodology used for the calculation of the nation’s official exchange rate by the FMDQ Exchange.

The review has pushed the Nigerian Autonomous Foreign Exchange Market rate (official exchange rate) from approximately N900/dollar to N1,480/dollar. The naira closed at 1,450/dollar at the parallel market on Tuesday.

The move which is aimed at unifying the official and parallel market exchange rates has been hailed by economists and other stakeholders.

They however challenged the CBN to clear FX backlogs estimated at over $5bn and also fund FX demands at the official market. This, they said, would forestall a situation whereby the parallel market rate would move away from the official rate again.

Apparently as part of the moves to fund FX request at the official window, the CBN in its latest circular released on Wednesday accused banks of holding excess foreign exchange positions.

As a result, the central bank gave lenders until February 1, 2024 (today) to sell off excess dollar positions.

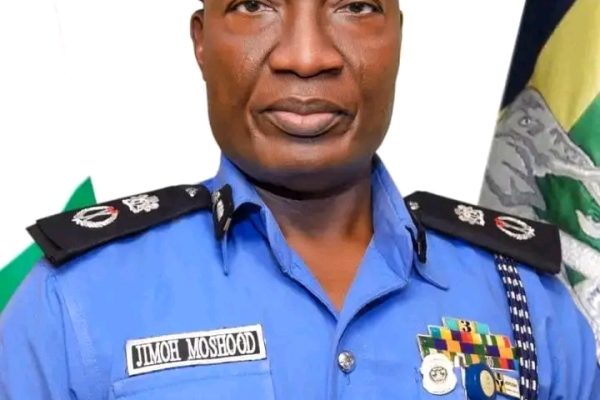

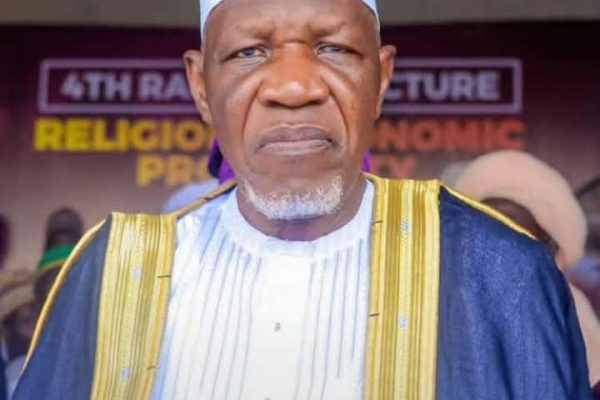

The circulated, dated January 31, 2024, was signed by the Director, Trade and Exchange, CBN, Dr. Hassan Mahmud, and representative of the Director, Banking Supervision, CBN, Mrs. Rita Sike.

The circular read in part, “The Central Bank of Nigeria has noted with concern the growth in foreign currency exposures of banks through their Net Open Position (NOP). This has created an incentive for banks to hold excess long foreign currency positions, which exposes banks to foreign exchange and other risks.”

To address these issues, the CBN in the circular issued prudential requirements that banks must follow. A key focus of these requirements is the management of the Net Open Position (NOP).

The NOP measures the difference between a bank’s foreign currency assets (what it owns in foreign currencies) and its foreign currency liabilities (what it owes in foreign currencies).

The circular mandates that the NOP must not exceed 20 per cent short or 0 per cent long of the bank’s shareholders’ funds.

This calculation, the apex bank said, must be done using the Gross Aggregate Method, which provides a comprehensive view of the bank’s foreign currency exposure.

Furthermore, banks with current NOPs exceeding these limits are required to adjust their positions to comply with the new regulations latest by February 1, 2024.

Additionally, banks must calculate their daily and monthly NOP and Foreign Currency Trading Position (FCT) using specific templates provided by the CBN.

The CBN also directed banks to maintain adequate stocks of high-quality liquid foreign assets, such as cash and government securities, in each significant currency.

According to the circular, all banks are required to adopt adequate treasury and risk management systems to provide oversight of all foreign exchange exposures and ensure accurate reporting on a timely basis.

Banks are expected to bring all their exposures within the set limits immediately and ensure that all returns submitted to the CBN to provide an accurate reflection of their balance sheets.”

Finally, the CBN warned banks that non-compliance with the NOP limit would result in immediate sanction and suspension from the foreign exchange market.

In the half of 2023, First Bank, UBA, Zenith, Access, and GTB reported a combined N1.38tn in forex revaluation gains.

The apex bank at the time issued a directive instructing commercial banks to resist using their foreign exchange revaluation gains for dividends and operational expenditures. It noted that “Banks that exceed the NOP prudential limits due to the FX revaluation shall be granted forbearance for the breach upon application.’’

A top bank executive, who spoke on condition of anonymity, said the new circular would force banks to sell off excess dollar liquidity exceeding $5bn

We will resume next tomorrow, and the rate should be less than N1,400/$,” the source added.

On the cryptocurrency peer-to-peer market, the naira was trading for N1,495.1/$ on Binance’s P2P platform as of the time of filing this report.

The naira is recording its worst week on the official market following the move by FMDQ Securities Exchange to revise the methodology used to set the exchange rate. According to a market notice, this new calculation will attempt to narrow the gap between the official and parallel rates of the naira.

It said, “This revision aims to address recent fluctuations and challenges encountered in the Nigerian Foreign Exchange (‘FX’) Market.”

It added, “These revisions are focused on enhancing the accuracy and reliability of the NAFEX and NAFEM rates determination process, with a focus on data availability and integrity involving a rigorous data validation process, including tolerance checks which shall be applied by FMDQ Exchange, subject to internal policies and procedures.”

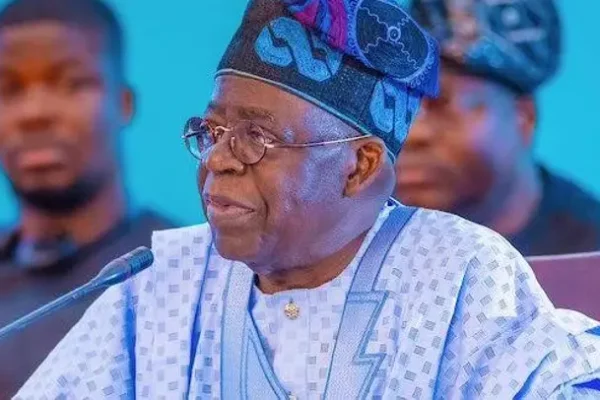

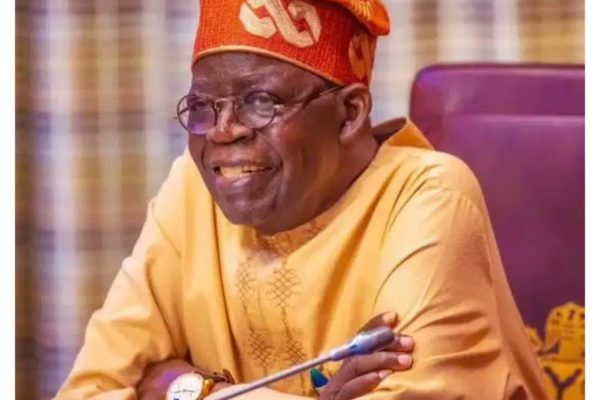

Senate summons Cardoso

Meanwhile, the Senate, on Wednesday, through its Committee on Banking, Insurance and Other Financial Institutions, summoned the Governor of Central Bank of Nigeria, Olayemi Cardoso, to appear before it on Tuesday next week to answer questions on the state of the economy and the naira’s fall in the forex market.

The Committee, chaired by Senator Adetokunbo Abiru (APC Lagos East), met on Wednesday when the naira plummeted to over N1,500/dollar and resolved to summon the CBN governor on the way out.

The naira at the official window on Tuesday, fell at an all-time low of N1,482 to $1.

The local unit had closed at 1,348 against the greenback on Monday after the FMDQ Security Exchange reviewed the methodology used for the calculation of its rates.

Speaking with journalists after the meeting held behind closed-doors at the National Assembly, Abiru said the state of the economy, especially the inflation index was of great concern to the lawmakers.

He said, “We have held a meeting this afternoon essentially to focus on the direction of the Nigerian economy.

“We are all living witnesses of what is going on. Underlining the major issue of the economy is the way the inflation index has been and of course, it is a major concern to us.

“We have deliberated among ourselves. Critical issues were addressed and we believe that the next line of action is to summon the CBN governor on Tuesday at 3 O’clock to brief us properly on the state of the economy.

![CAC removes 247 companies from database [Full List]](https://theprimenews.ng/wp-content/uploads/2025/08/Corporate-Affairs-Commission-CAC-building--600x400.webp)

![‘I love Natasha’ – 2Face announces marriage plans with Edo lawmaker [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/02/GridArt_20250203_143302913-scaled-1-600x400.jpg)

![Europa League: 7 teams qualify for Round of 16, knockout stages [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/258743-1024x538-1-600x400.jpg)

![‘Jesus take the White House’ – Nathaniel Bassey ministers at Trump’s prayer breakfast [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Nathaniel-Bassey-1024x681-1-600x400.webp)

![Copa del Rey: All 8 teams in quarterfinal confirmed [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/1126686360.jpg.0-1024x683-1-600x400.webp)

![‘I’m waiting on the Lord for kids’ – Eniola Badmus [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Eniola-Badmus-1024x764-1-600x400.webp)

![FIFPRO announces nominees for 2024 Men’s World XI [Full list]](https://theprimenews.ng/wp-content/uploads/2024/12/Image_20241202_160846_058-600x391.webp)

![Jagun Jagun wins big at 2024 BON Awards [FULL LIST]](https://theprimenews.ng/wp-content/uploads/2024/11/20241013_181847-1024x715-1-600x400.jpg)