…we’re poise to bring out best in our employees – MD

Reactions have continue to trail the just concluded two weeks training and orientation programs for the staff of Kwara Poly Microfinance Bank, as participants describe the event as incredible and insightful.

The event which was powered by Kwara Poly MFB Limited, held at Halbash Hotel, Ilorin was aimed at maximising the productivity of its staff and help staff develop their skills to become more effective in their roles.

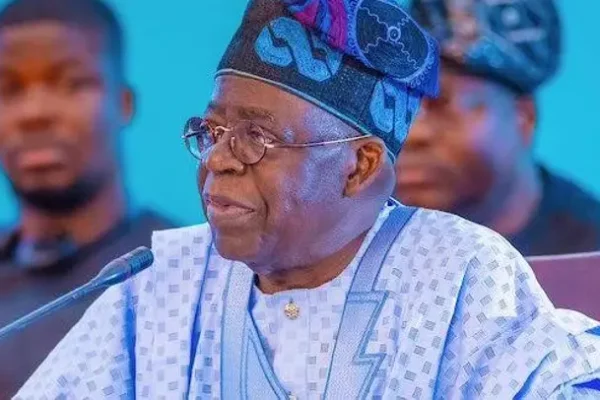

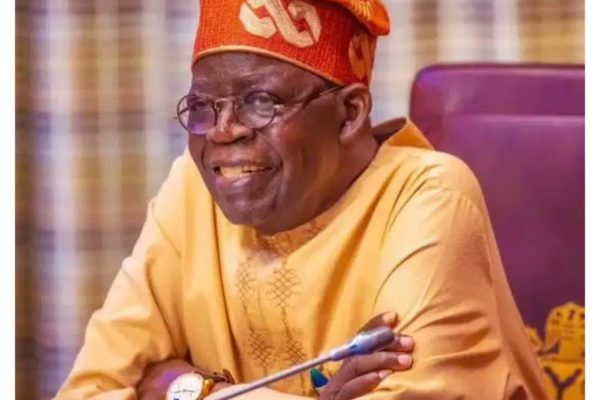

Speaking with our reporter at the event, the Managing Director, Kwara Poly Microfinance Bank Limited, Mall. Ismail Taiye Abdullahi said the reason for the training is to bring out the best in his employees and to increase their knowledge.

According to him, ‘Training is important because it represents a good opportunity for our employees to grow their knowledge base and improve their job skills to become more effective in the discharge of their duties.’

“Being a new Micro Finance Bank, we want our staff to be one of the best customer care you can think of. They need to know what to do when it comes to operation.

“Our training is ongoing one, this is just the beginning. We’re are poised to increase their knowledge, open their heart to what they are going to face in the banking industry by listening to best resource persons,” the MD said.

Abdulahi added that though KPM Bank is in its embryonic stage, it’s activities are in strict compliance with directive and policies of the Central Bank of Nigeria, saying the staffer of the bank will undergo intermittent sponsorship and weekly in-house training.

“We have engaged the service of the best hand to handle this training and as you can see it is an interactive one. Immediately after this training, they will be resuming at office proper and every week there going to be in-house training. We will be sponsoring them intermittently.

“From the report I received, participants have been very impressed with what they have learnt and no doubt we are going to get the best out of them by ploughing back what they have gained to bring about optimal service delivery, ” the soft spoken MD affirmed.

Earlier, participants at the training responded that they were relatively satisfied with the training and orientation scheme, lauding KPM Bank management.

In his view, one of the participants, Mr. Sakariyau Abubakar Tunde said he has been well equipped on the nitty-gritty of the banking industry, saying the resource person(s) have been helpful and professional.

“I am here purposely for training aimed at becoming a banker. I have learnt a lot from this program. This training has afforded me to to understand why a banker has to be responsible for any financial activities in the bank.

“The resource personalities have been helpful and professional. They are vast experience is second to none. I thank the management of Kwara Poly Microfinance Bank for this laudable fits, ” Abubakar said.

For AbduRahman Ismail Olamilekan, he affirmed his participation at the training and orientation as not accidental, saying it has been his childhood ambition to become a banker.

“I wouldn’t say my presence at the training was accidental because I had agelong passion to become a banker. I have gained a lots of experience particularly on how to address customers.

“Banking is a good job, but it deserves more commitment. A banker has to be more sensitive in advising customers,” AbdulRahman stressed.

Solape Jato, a banker also lend her credence to the management board of the Kwara Poly Microfinance Bank for organizing such an educative training, alluding to the fact that the orientation programs has grossly impacted the participants.

“I was a banker with vast banking experience prior now and I can attest to you that this training has been wonderful with intellectual professionals that had tutored us here. They have impacted us more as far as this training is concern,” she said.

“I don’t know much about banking before now, but with this training, we have been taught on how to attend to customers at the same time opens our eyes to know the difference between commercial bank and microfinance bank,” Serifat Bolanle also confirmed.

![CAC removes 247 companies from database [Full List]](https://theprimenews.ng/wp-content/uploads/2025/08/Corporate-Affairs-Commission-CAC-building--600x400.webp)

![‘I love Natasha’ – 2Face announces marriage plans with Edo lawmaker [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/02/GridArt_20250203_143302913-scaled-1-600x400.jpg)

![Europa League: 7 teams qualify for Round of 16, knockout stages [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/258743-1024x538-1-600x400.jpg)

![‘Jesus take the White House’ – Nathaniel Bassey ministers at Trump’s prayer breakfast [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Nathaniel-Bassey-1024x681-1-600x400.webp)

![Copa del Rey: All 8 teams in quarterfinal confirmed [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/1126686360.jpg.0-1024x683-1-600x400.webp)

![‘I’m waiting on the Lord for kids’ – Eniola Badmus [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Eniola-Badmus-1024x764-1-600x400.webp)

![FIFPRO announces nominees for 2024 Men’s World XI [Full list]](https://theprimenews.ng/wp-content/uploads/2024/12/Image_20241202_160846_058-600x391.webp)

![Jagun Jagun wins big at 2024 BON Awards [FULL LIST]](https://theprimenews.ng/wp-content/uploads/2024/11/20241013_181847-1024x715-1-600x400.jpg)