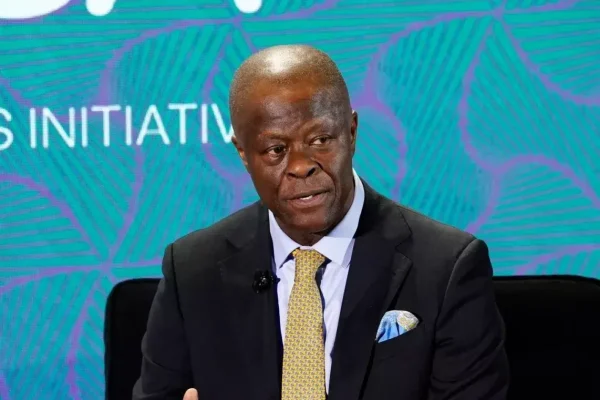

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, on Friday disclosed that a forensic audit of the Nigerian National Petroleum Company Limited is ongoing, as part of efforts to scrutinise oil revenue deductions and boost remittances into the Federation Account.

“It is an ongoing forensic audit of NNPC as mandated by the Federation Account Allocation Committee meeting. That is ongoing,” Edun said at a press conference in Abuja where he briefed stakeholders on recent developments in the Nigerian economy.

The minister explained that the audit is running alongside the implementation of a new presidential executive order directing that certain oil and gas revenues be paid directly into the Federation Account.

According to him, the review is examining deductions and charges that reduce what eventually accrues to the Federal Government, states and local governments.

He said the Federal Executive Council had earlier mandated a subcommittee to scrutinise “the deductions from the Federation Account, and in particular, the costs of collection of some of the deductions that were going on and the amounts that were being charged for actually doing that task.”

Edun added, “It’s within that context of looking at what should come into the Federation Account and what was going elsewhere that we have now been directed by Mr President, as owner of the executive order, to immediately flow these three elements, management fee, frontier fund, as well as the gas flare penalty, directly to the Federation Account.”

He stressed that the directive does not override any ongoing legislative or institutional processes.

“It does not prejudice anything else that is ongoing, whether at the National Assembly or the legislature or any other action that is looking at this all-important area of the Federation Account, the accuracy, the transparency, and the accountability of the funds that are going to flow into it,” he said.

According to the minister, a committee comprising federal and state representatives has been constituted to ensure efficient implementation of the directive and is scheduled to meet next week.

Edun indicated that the combined effect of the executive order and the forensic audit would clarify the long-debated issue of alleged remittance backlogs.

Linking the development to broader fiscal reforms, the minister said Nigeria must intensify domestic resource mobilisation in the face of elevated global interest rates and limited fiscal space.

“Within that context, there is a need to focus on domestic resource mobilisation, rather than debt financing that is not self-paid,” he said, warning that heavy debt service obligations crowd out spending on health, education and infrastructure.

On revenue transparency, Edun said the government is deploying technology across ministries, departments and agencies to block leakages and improve accountability.

He disclosed that revenue-earning agencies have been directed to migrate to a unified digital platform.

“All revenue-earning agencies should be on the same technical platform. An investment has been made in technology. We have advisors. We have a consortium. And the revenue agencies are given that platform on which to collect funds. Everybody will see how much somebody is meant to pay, how much he has paid, and how much he is owing,” he said.

He added that cash payments for government services would be discontinued from February 20, describing manual cash handling as incompatible with modern public finance management.

The minister also addressed concerns about the cost of collection by certain agencies, noting that under existing financial regulations and the Fiscal Responsibility Act, agencies are restricted in the portion of revenue they can retain.

“Under the financial regulations, under the Fiscal Responsibility Act, effectively, no matter what the likes of NUPRC or others collect, they’re only entitled to spend a maximum of 50 per cent of it. Their surplus must come to the government,” he said.

Beyond oil revenue issues, Edun disclosed that the government is engaging private equity investors over concerns around the application of capital gains tax. He warned that sudden capital exits could destabilise markets.

“It can affect the markets dramatically, because if they all decide that on one day, this doesn’t pay them, and they’re off, it would be negative for us, so we have every reason to sit down with them and discuss the issue of capital gains tax,” he said, reiterating the government’s preference for long-term, job-creating investments.

He also said no revenue-generating public asset is off limits to serious investors willing to propose concession or partnership arrangements, including airports, seaports and other infrastructure.

On social protection, the minister said 9.1 million households have benefited at least once from the direct benefit transfer programme, with another one million set to be paid and about five million more to be covered before completion of the current phase.

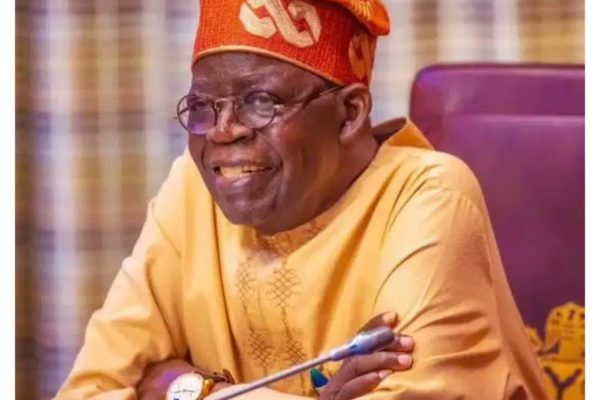

In April 2025, THE PRIME NEWS reported that Edun announced that a forensic audit of the Nigerian National Petroleum Company Limited will begin soon.

He revealed this at the Nigerian Investor Forum, held alongside the IMF/World Bank Spring Meetings in Washington DC.

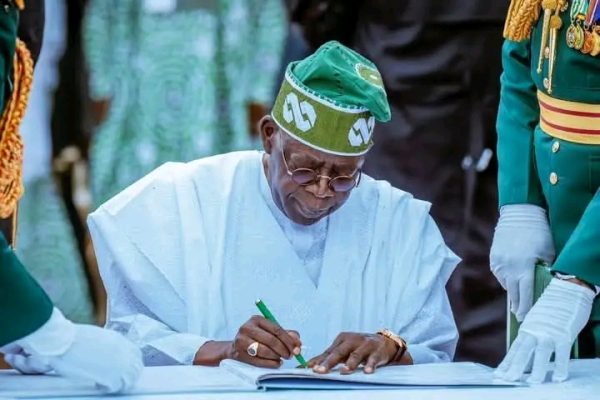

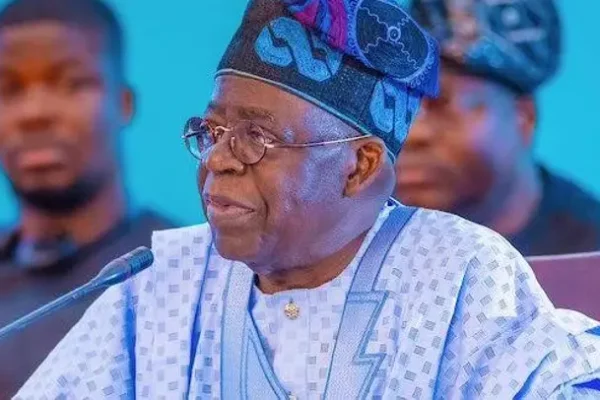

THE PRIME NEWS also reported that President Bola Tinubu suspended the collection of management and frontier exploration fees by the Nigerian National Petroleum Company Limited as part of a sweeping Executive Order aimed at safeguarding oil and gas revenues due to the Federation.

![CAC removes 247 companies from database [Full List]](https://theprimenews.ng/wp-content/uploads/2025/08/Corporate-Affairs-Commission-CAC-building--600x400.webp)

![‘I love Natasha’ – 2Face announces marriage plans with Edo lawmaker [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/02/GridArt_20250203_143302913-scaled-1-600x400.jpg)

![Europa League: 7 teams qualify for Round of 16, knockout stages [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/258743-1024x538-1-600x400.jpg)

![‘Jesus take the White House’ – Nathaniel Bassey ministers at Trump’s prayer breakfast [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Nathaniel-Bassey-1024x681-1-600x400.webp)

![Copa del Rey: All 8 teams in quarterfinal confirmed [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/1126686360.jpg.0-1024x683-1-600x400.webp)

![‘I’m waiting on the Lord for kids’ – Eniola Badmus [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Eniola-Badmus-1024x764-1-600x400.webp)

![FIFPRO announces nominees for 2024 Men’s World XI [Full list]](https://theprimenews.ng/wp-content/uploads/2024/12/Image_20241202_160846_058-600x391.webp)

![Jagun Jagun wins big at 2024 BON Awards [FULL LIST]](https://theprimenews.ng/wp-content/uploads/2024/11/20241013_181847-1024x715-1-600x400.jpg)