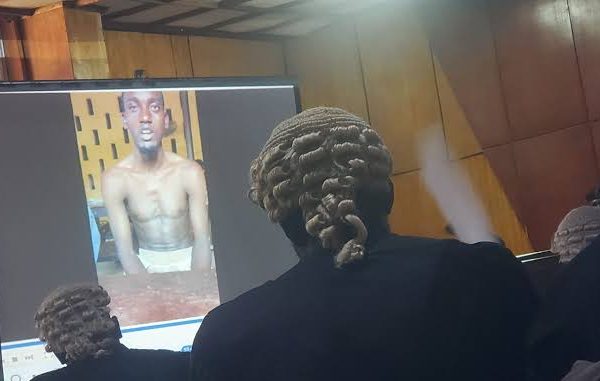

The Economic and Financial Crimes Commission (EFCC), has arraigned one Rufus John Isip, a self-acclaimed forex broker before Justice C. S. Onah of the Federal High Court sitting in Uyo, Akwa Ibom State for alleged N2 billion investment scam.

A statement by EFCC spokesperson, Dele Oyewale on Saturday said the suspect was arraigned alongside his company, ITM-IT Resources Limited, on an eight-count charge bordering on fraudulent conversion, money laundering and obtaining by false pretence.

According to the statement, “Count one of the charge reads: That you, Rufus John Isip while being the Director of ITM-IT Resources Limited and ITM-IT Resources Limited sometime in December 2020 and May 2021 in Uyo, Akwa Ibom State, within the jurisdiction of the Federal High Court of Nigeria, with intent to defraud, obtained the sum of (431, 331, 172. 00) Four Hundred and Thirty-one Million, Three Hundred and Thirty-one Thousand, One Hundred and Seventy-two kobo from one Michael Okon, the Director of N-Rex Resources Limited under the false pretence that it is an investment in Vandera, an online investment platform, on his behalf, which pretence you knew to be false and thereby committed an offence contrary to Section 1 (1) (a) of the Advance Fee Fraud and Other Fraud Related Offences Act, 2006 and punishable under Section 1 (3) of the same Act.”

The statement noted that the suspect pleaded not guilty when the charges were read to him and Khamis Mahmud, counsel to the EFCC, prayed the court to remand him in EFCC custody.

Justice Onah adjourned the matter to October 14, 2024 for trial and the defendant was remanded at the Uyo Zonal Directorate of the EFCC.

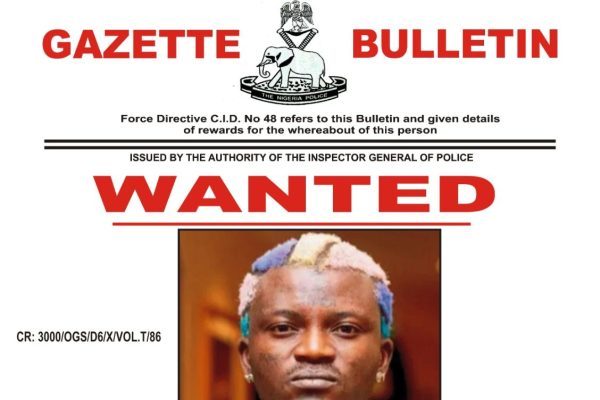

The statement added, “Isip was arrested based on a petition from one Michael George, alleging that he lured him to invest in his online trading platform called Vandora.io.

“According to the petitioner, the defendant told him that it was more profitable to trade on his platform with a minimum trading capital of $100, 000. 00 (One Hundred Thousand Dollars) and that he would earn more profit if he involved more investors.

“The petitioner thereafter invested, reached out to other investors and companies who also invested in the defendant’s phony online trading platform and after 60 days (as agreed) for the investors to start earning their profits, the defendant disappeared into thin air.”

EFCC arraigns forex broker for alleged N2bn investment scam

![‘I love Natasha’ – 2Face announces marriage plans with Edo lawmaker [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/02/GridArt_20250203_143302913-scaled-1-600x400.jpg)

![Europa League: 7 teams qualify for Round of 16, knockout stages [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/258743-1024x538-1-600x400.jpg)

![‘Jesus take the White House’ – Nathaniel Bassey ministers at Trump’s prayer breakfast [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Nathaniel-Bassey-1024x681-1-600x400.webp)

![Copa del Rey: All 8 teams in quarterfinal confirmed [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/1126686360.jpg.0-1024x683-1-600x400.webp)

![‘I’m waiting on the Lord for kids’ – Eniola Badmus [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Eniola-Badmus-1024x764-1-600x400.webp)

![FIFPRO announces nominees for 2024 Men’s World XI [Full list]](https://theprimenews.ng/wp-content/uploads/2024/12/Image_20241202_160846_058-600x391.webp)

![Jagun Jagun wins big at 2024 BON Awards [FULL LIST]](https://theprimenews.ng/wp-content/uploads/2024/11/20241013_181847-1024x715-1-600x400.jpg)