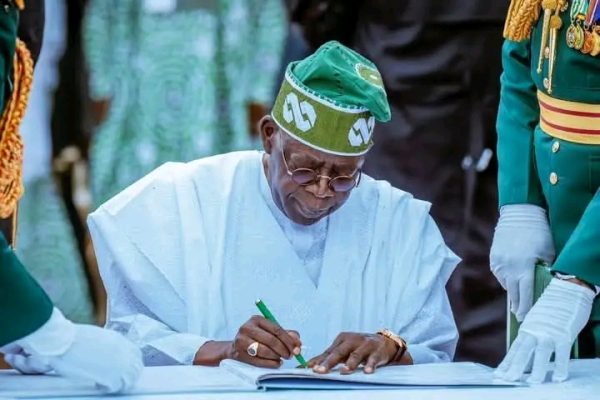

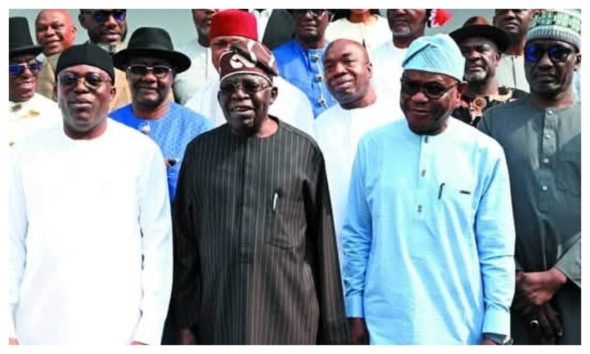

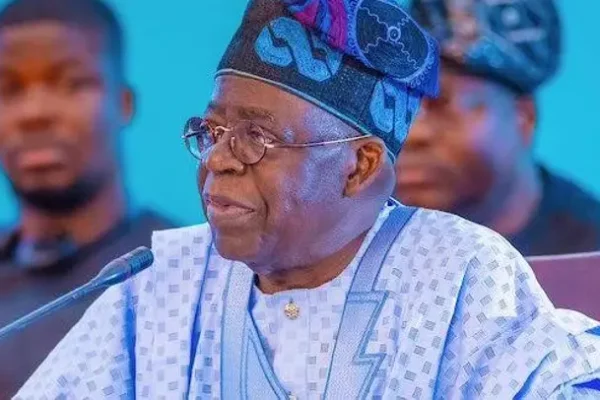

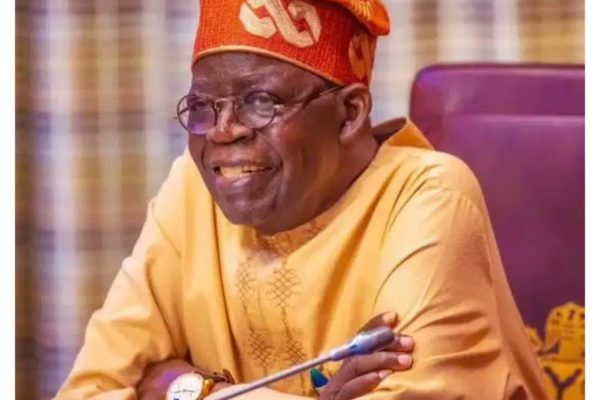

The Central Bank of Nigeria has given commercial banks and forex market dealers permission to freely sell forex at market-determined rates, aligning with President Bola Tinubu’s commitment to unify exchange rates. This suggests that Nigeria is transitioning to a freely floating exchange rate system.

The impact of this move include:

1. Market-Based Rate: The exchange rate will be determined by supply and demand, reflecting the true value of the naira against the dollar more accurately.

2. Exchange Rate Volatility: The shift to a freely floating exchange rate system can introduce increased volatility in the currency market. The exchange rate may fluctuate more frequently and by larger magnitudes, which can pose challenges for businesses, consumers, and investors. It becomes crucial for market participants to closely monitor exchange rate movements and adjust their strategies accordingly to mitigate potential risks.

3. Transparency and Fair Pricing: With a single market rate, there is less incentive for individuals and businesses to resort to the parallel market. Transparent pricing reduces the risk of unofficial rates and scams.

4. Enhanced Availability: Allowing commercial banks and forex dealers to freely sell forex can enhance the availability of foreign currency in the market. This can potentially address the issue of limited supply to some extent, making it easier for individuals and businesses to access foreign exchange for legitimate transactions. The increased availability can facilitate smoother cross-border trade and investment activities. In essence, the banks and forex dealers who now have a free hand to set their prices based on market dynamics and not by regulatory fixing, will no longer be incentivised to move the dollars at their disposal to the black market for larger margins. This will improve the supply of dollars in these official channels.

5. Reduced Arbitrage Opportunities: The gap between official and parallel market rates is expected to narrow, making parallel market activities less profitable.

6. Implications for Inflation and Interest Rates: The depreciation of the Naira resulting from a freely floating exchange rate can have implications for inflation and interest rates. A depreciating currency tends to increase the cost of imported goods, which can contribute to higher inflation. To manage inflationary pressures, the central bank may opt to tighten monetary policy by raising interest rates. This can impact borrowing costs for businesses and individuals, potentially influencing investment decisions and overall economic activity.

While the complete elimination of the parallel market may take time, gradually reducing its prevalence is possible through increased confidence in the official market, exchange rate stability, and effective regulations.

Overall, the move towards a freely floating exchange rate system in Nigeria has the potential to bring about positive changes in the forex market, benefiting individuals, businesses, and the overall economy.

Credit Kolawole Raji

![CAC removes 247 companies from database [Full List]](https://theprimenews.ng/wp-content/uploads/2025/08/Corporate-Affairs-Commission-CAC-building--600x400.webp)

![‘I love Natasha’ – 2Face announces marriage plans with Edo lawmaker [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/02/GridArt_20250203_143302913-scaled-1-600x400.jpg)

![Europa League: 7 teams qualify for Round of 16, knockout stages [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/258743-1024x538-1-600x400.jpg)

![‘Jesus take the White House’ – Nathaniel Bassey ministers at Trump’s prayer breakfast [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Nathaniel-Bassey-1024x681-1-600x400.webp)

![Copa del Rey: All 8 teams in quarterfinal confirmed [Full list]](https://theprimenews.ng/wp-content/uploads/2025/01/1126686360.jpg.0-1024x683-1-600x400.webp)

![‘I’m waiting on the Lord for kids’ – Eniola Badmus [VIDEO]](https://theprimenews.ng/wp-content/uploads/2025/01/Eniola-Badmus-1024x764-1-600x400.webp)

![FIFPRO announces nominees for 2024 Men’s World XI [Full list]](https://theprimenews.ng/wp-content/uploads/2024/12/Image_20241202_160846_058-600x391.webp)

![Jagun Jagun wins big at 2024 BON Awards [FULL LIST]](https://theprimenews.ng/wp-content/uploads/2024/11/20241013_181847-1024x715-1-600x400.jpg)